A new report by the USC Program for Environmental and Regional Equity (PERE), confirms deep inequities in the current commercial property tax system and the potential of significant revenue gains by closing Prop 13’s corporate tax loopholes and addressing its systemic flaws.

Over the last two years, USC PERE analyzed commercial property tax records between 2004 and 2013 with a rigorous methodology to calculate county level revenue estimates.

Here is what they found:

- California schools and local government services would receive $9 billion in additional revenues in 2019-2020 by reassessing commercial properties at fair market value

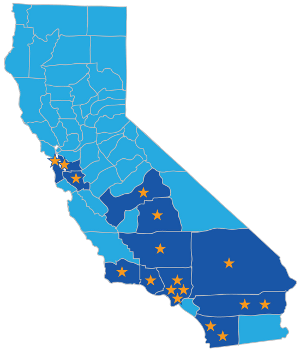

- By 2019-2020, the 12 counties where California Calls anchor organizations engage community members would realize $6.6 billion in new revenue, including $2.9 billion for Los Angeles County alone.

- Per capita benefits are broadly shared between urban and rural regions and across northern, southern and coastal counties, ranging from $44 in Lake County to $858 in San Francisco.

These new estimates – along with the findings that homeowners have paid the lion’s share of local taxes compared to commercial properties since Prop 13 was passed, provide strong evidence for the need for reform. California Calls and the 22 organizations who have joined the Make It Fair campaign will be working to bring this new study and its implications into the public policy debate for 2016 and beyond. Next steps will be announced later this year.