Did you know that before Prop 13 was passed, commercial properties and residential properties contributed equally (about 50/50) to the local tax base? But by 2012, residential properties were carrying the lion’s share (an average of 72%), while the share paid by commercial properties—some of them the biggest multi-national corporations in the world—drastically declined?

Neither did we until we uncovered this startling fact and much more in the first phase of a multi-year project to study Commercial Property Tax Reform as a major solution to California’s revenue problem. California Calls, the California Tax Reform Association (CTRA) and USC Program for Environmental and Regional Equity (PERE) launched the second phase of this research at the beginning of this year. The research will expand to analyze the trends over time, the inequities between different types of commercial properties and other sectors, and to assess the impact of current commercial property tax policies on state and county revenues.

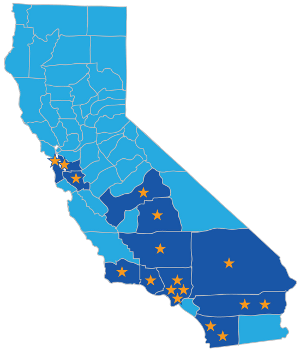

This project has attracted growing interest and participation. Currently 37 organizations are participating on five project work groups and 15 organizations on the project steering committee. This diverse set of labor, civil rights, housing, social justice and community groups plan to:

- Assess current public awareness, understanding and attitudes on property taxes.

- Explore how to talk to the public on the results of the research.

- Build broader public awareness of current commercial property tax policies and their implications.

Results of the second phase of the Commercial Property Tax Reform project will be released later this year and will inform next steps for fixing California’s broken commercial property tax system.