What are property taxes?

Property taxes are taxes that all property owners pay yearly based on the value of their homes, businesses or land. The taxes are collected by local governments – counties, cities, school districts, and other special districts – to fund programs and services. Property Tax revenue pays for the things we use every day. Our roads, parks, libraries, county health departments and other local services are all partly funded through property taxes. Click here to learn more. [link to property tax page]

What is Proposition 13?

Prop 13 was passed in 1978 by California voters as protection for single-family homeowners. It imposes an annual cap on property value reassessment for taxing purposes. While this measure has successfully protected homeowners, the legislation also allows some big corporations to exploit loopholes and avoid paying their fair share of commercial property taxes.

What are the loopholes that corporations use to avoid paying their fair share?

First, because the taxable value of a property is set at the time of purchase and artificially limited to a 2% increase in value each year, a big corporation could be paying just slightly more in property taxes today than they did in 1978 — even if their property has become far more valuable.

Worse, some companies actively work to get around re-assessment even when a piece of property changes hands. Under legislation associated with Prop. 13, if over 50% of ownership is transferred to one new owner, the property is then re-assessed. Some corporations and wealthy commercial property owners will break up the ownership of a piece of property across several sub-corporations so that no one sub-corporation owns more than 50%. So even though the property has been bought and sold, the new owners are paying taxes under the old assessment value.

This is fundamentally unfair — it allows many big corporations and wealthy commercial property owners to pay less than they should, leaving Californians with less funding for important community priorities, like schools and local services, that benefit everyone.

Will reforming Prop 13 for businesses impact homeowners?

This will not impact homeowners or renters at all — except to make the communities we live in and the services we use stronger.

Will reforming Prop 13 for big corporations impact small businesses?

We know small businesses are the economic engine of our state. Currently, the commercial properties owned by some businesses are assessed at their current market values because the businesses are not exploiting the Prop. 13 loopholes. Any legislation to change commercial property taxes will help level the playing field between all businesses.

Will raising taxes on businesses encourage them to move out of California?

No – California is one of only two states that doesn’t reassess commercial properties regularly. California also has one of the lowest property tax rates in the country (1%), which will continue to be true if these commercial property tax loopholes are closed. California is also the eighth largest economy in the world by some estimates, and the economic climate is advantageous for businesses in general. Businesses want to do business in California because of our economic strength.

Won’t businesses just pass along the tax increase to renters and consumers?

Rents and prices for goods and services are not based on the property taxes businesses pay. Landlords charge rents based on what the market allows them to charge (buildings that have avoided reassessment are not cheaper to rent than similar buildings that have been reassessed). Disneyland has raised its ticket prices 809% since 1978 even though their property taxes have remained virtually the same. The price of gas is not based on what Chevron pays in property taxes. The bottom line is that there is no evidence that Prop. 13 loopholes for commercial property have benefited renters or consumers. In fact they have led to increases in other taxes and fees that hurt individuals and small businesses.

How much money would be raised by closing the loopholes? What would that money be used for?

A recent study by USC Program for Environmental & regional Equity found that California could collect an estimated $9 billion more a year if we closed the reassement loophole for commercial properties.

Currently, property taxes go to school districts, cities, counties and special districts that use the funding for K-12 education; local services like parks, libraries, police and fire; roads and other infrastructure, and community colleges. We propose to use increased revenue for the same things our property taxes go to now: increased funding for schools and local services.

We already passed Prop 30, why do we need more revenue?

Proposition 30 was a step in the right direction, raising $6 billion for education and needed services. For the first time in many years, California schools did not face more cuts. But the unfortunate reality is that since many big corporations and wealthy commercial property owners have exploited loopholes in the law, we’ve been under-investing in schools and essential services for years. Proposition 30 is a temporary measure, with the sales taxes expiring in 2016 and the income taxes expiring in 2018.

In addition to Proposition 30, we need a permanent solution that closes commercial property tax loopholes, levels the playing field for businesses and provides additional funding for public schools, the social safety net, community colleges and other needed services.

How long would it take for the reform to happen?

Reassessing corporate properties wouldn’t happen overnight. It would take about 4 years to bring corporate properties to current market value and start collecting the full $9 billion for California.

What if California cut spending on government jobs and pensions? Couldn’t we find the funding we need if we cut government waste?

State employees — the vast majority of whom are middle-income workers — only account for about 25% of the budget. While improving government efficiency is a worthwhile goal, cuts to state jobs will not create the necessary resources to strengthen schools and public services — and would likely result in the further deterioration of services we all rely on.

Many big corporations and wealthy commercial property owners have spent the past 30 years exploiting the law to avoid paying their fair share. This has hurt public services, but it has also had an adverse impact on new businesses and start-ups that must compete against them. We’re seeking to restore fundamental fairness to help us improve services and create a level playing field.

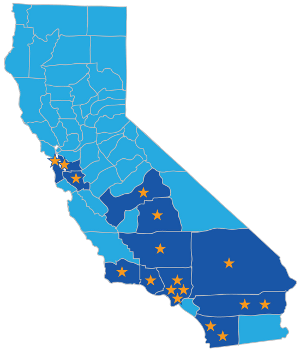

What is the Make It Fair Campaign?

Make It Fair is a coalition of community, faith-based, civil rights and labor groups all working together to find solutions for the problems in our state caused by the lack of funding for public education and other services we all use, while also leveling the playing field for small and large, old and new businesses in California.