In a state where 1 in 7 people are living in poverty and the top 1% of Californians earn in 1 week what middle-income Californians earn in 1 year, no Californian can look around and argue that there isn’t a need for greater tax fairness and a redistribution of resources. Now is the time to fully restore the $20 billion in budget cuts to education, safety net and local services which are the lifeline for millions of poor, low-income and working class families.

At the end of June, Governor Brown signed the new $115 billion California state budget for 2015-16. This includes $14 billion more in revenue than anticipated in the governor’s original budget[1], partly due to Prop 30, the temporary initiative passed in 2012 that raised taxes on the wealthy to fund education and services. The legislature has made some attempts to use this revenue to meet the needs of communities hurt most by the $20 billion in budget cuts since 2009 still plaguing many communities across the state.

The budget offers a number of new funding priorities, including the state’s first Earned Income Tax Credit for 825,000 low-income families, an 18-month debt amnesty program for low-income Californians with over-due court-ordered fines, $6 billion in funding for K-14 education for disadvantaged students, freezing University of California tuition for California residents for two years, and, in a bold policy move, expanding Medi-Cal eligibility to 170,000 undocumented children[2].

Many have described the $14 billion in additional revenue a budget “surplus”, declaring that the state is “flush” with revenue. Unfortunately, most Californians have yet to feel the impact of this so called “economic resurgence”, as schools and neighborhood services are still shattered after a decade of more than $20 billion in budget cuts.

- Low-Income families – As of April 2015, a family of three only receives $704 a month in public assistance — an amount impossible to make ends meet. The new budget does not increase benefits or restore cost-of-living adjustments (which were frozen in 2010) for CalWORKs grants. Cuts to these critical benefits have devastated low-income communities for over two decades. In 1989-90, a family of three received $694 a month. If the grant had been adjusted for inflation and the cost of living, the same family should now receive $1430 a month.

- Seniors and the Disabled – California’s most vulnerable – 1.3 million low-income seniors and people with disabilities – will continue to struggle with deeply reduced benefits. California currently pays the minimum level of support allowed by the federal government. This is less than half the support they would be eligible for if benefits had been adjusted for inflation every year since 1990.

- Early Childhood Education – Working families will continue to struggle to find affordable child care. Between 2007 and 2014, 100,000 childcare and preschool slots were cut from the budget. The 2015-16 budget restores 16,000 slots.

- Healthcare – Many basic medical benefits for adults receiving Medi-Cal are still not covered, including the full range of dental benefits and other critical benefits including glasses, speech therapy and audiology.

- In-Home Supportive Services – Homecare workers, the lifeline for many aging seniors, will continue to work with low wages and reduced hours. The new budget rolls back the 7 percent cut to the authorized hours of care for homecare workers, but the state cannot afford to permanently maintain the restoration. The budget also continues to delay the implementation of overtime for homecare workers pending a federal court decision.

- Higher Education – Although the 2015-16 budget freezes tuition for Californian residents attending University of California and California State Universities until 2017, there is no substantive solution to address the skyrocketing costs of California’s public colleges and universities.

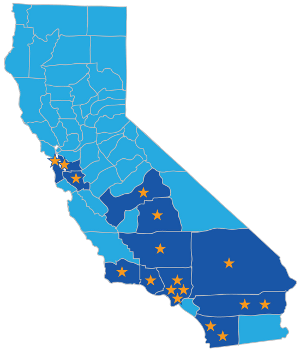

After signing the 2015-16 budget Governor Brown has called for two special sessions of the legislature to address funding for transportation and health & human services. It’s time for our state to turn to ambitious policies that create permanent funding and long-term solutions. That’s why California Calls has joined the Make It Fair movement – a coalition of community, faith-based, civil rights and labor organizations committed to closing corporate property tax loopholes while protecting homeowners, renters and small businesses to generate an estimated $9 billion more statewide.

[1] Page 11 and 12 http://www.ebudget.ca.gov/2014-15/pdf/Enacted/BudgetSummary/SummaryCharts.pdf

[2] page 5 http://calbudgetcenter.org/wp-content/uploads/2015_16-State-Budget-Package_First-Look_06292015.pdf