California Calls, a statewide coalition of community based organizations, released the following statement from President Anthony Thigpenn in response to Governor Brown’s revised 2015-16 budget:

“While the Governor’s revised budget makes an attempt at addressing poverty in California with a state Earned Income Tax Credit, the state still has a long way to go to restore funding from a decade of devastating cuts to services. This proposal will help 825,000 Californian families (or 2 million individuals)[1] who struggle to pay rent and buy groceries on a daily basis, but in a state where more than 1 in 7 Californians live in poverty[2], we need to do more to restore the safety net. The new budget also provides a two-year UC tuition freeze[3] and an 18 month amnesty program[4] with individuals with past due court ordered traffic infractions – but does not go far enough in creating permanent solutions. Furthermore, the increase in the state’s revenue and spending on education is largely due to Prop 30, which begins to expire next year.”

“The revised budget is a reminder of the long-term impacts felt by loopholes in Prop 13 that allow corporations and wealthy commercial property owners to avoid paying their fair share in taxes. In order to create full investment in the services that Californians need, the state must close corporate property tax loopholes and create a permanent source of revenue. That’s why California Calls has joined the Make It Fair movement – a coalition of over 22 community, faith-based, civil rights and labor organizations committed to closing corporate property tax loopholes while protecting homeowners, renters and small businesses.”

###

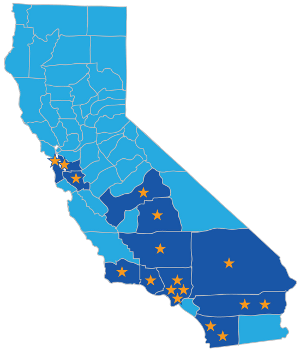

California Calls is a growing alliance of 31 grassroots, community-based organizations spanning urban, rural and suburban counties across the state. We engage, educate and motivate new and infrequent voters among young people, from communities of color, and from poor and working class neighborhoods to make California’s electorate reflect our state’s diverse population. Through our bottom-up approach, we are organizing voters most impacted by budget cuts and deteriorating public services in support of systemic, progressive solutions to our state’s fiscal crisis. Working together, and including those who are often left out of policy decisions, we believe we can reclaim the California Dream of equality, opportunity and prosperity for all Californians.

[1] “The proposed credit would match 85 percent of the federal credit at the lowest income levels, providing an average estimated household benefit of $460 annually for 825,000 families (representing 2 million individuals), with a maximum benefit of $2,653. “ http://www.ebudget.ca.gov/2015-16/pdf/Revised/BudgetSummary/FullBudgetSummary.pdf Page. 7

[3] “Holding tuition flat at the state’s universities for California undergraduate students for two more years by providing increased ongoing funding” Page 2 of may revision

[4] The Governor’s Budget included an 18‑month amnesty program that authorizes individuals with past due court‑ordered debt owed prior to January 1, 2013, relating to traffic infractions, to pay outstanding delinquent debt at a 50‑percent reduction if the individual meets specified eligibility criteria. Overall, the amnesty program is estimated May Revision – 2015-16 Public Safety 52 pTM5Aif3Jb to generate $150 million, which will help avoid structural deficits within many of the eight special funds supported by the State Penalty Fund. Approximately $12 million of the $150 million is expected to be deposited in the State Penalty Fund. Page 51-52 of may revision