While much has been written about Prop 13, the 1978 ballot initiative that locked property tax rates and ham-stringed legislators from raising revenue, the focus has largely been on the benefits to long-time homeowners who saw immediate relief in their property taxes. Very little analysis has been generated on the biggest beneficiaries of Prop 13 – commercial property owners who have avoided re-assessment for decades. Recent news stories have exposed loopholes that affect commercial property and recent legislation is putting the spotlight on addressing these inconsistencies.

The latest example to hit the news was billionaire computer founder Michael Dell who bought the Fairmont Miramar Hotel in Santa Monica in 2006, then found a way—via high-priced lawyers—to change up the deal to avoid a legal change in ownership. That move saved him about $1 million in property taxes each year, an option homeowners do not have themselves.

Earlier this year, California Calls, USC’s Program for Regional and Environmental Equity (PERE) and the California Tax Association, embarked on a six-month long project to study this often-ignored, yet critical piece of tax reform.

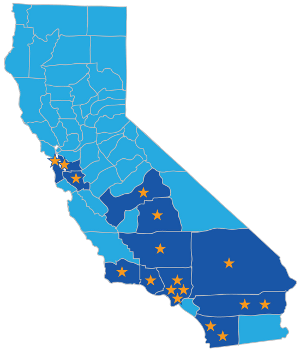

In this initial examination of 11 of the state’s 58 counties, the data underscores the inequities between residential and commercial property tax rates:

- Homeowners, not commercial property owners, are paying for the lion’s share of property taxes that support schools, roads and city services.

- Commercial land is under-valued in most counties, meaning many owners—including a number of large corporations—do not pay their fair share in property taxes.

- The gap between market and assessed land values is greater for commercial properties than for residential properties in most counties, indicating that many commercial property tax owners gained the most from the protections intended for homeowners in Prop 13.

The initial phase of this research strongly suggests that Prop 13’s commercial property tax provisions result in unequal and uncompetitive tax advantages for many at the expense of homeowners and other businesses who pay their fair share.

Our next step will be to share these preliminary results with a number of allied organizations, while a more in-depth data analysis takes place. We anticipate that next year, a report that analyzes statewide property tax inequities with profiles and examples for key counties around the state will be produced for broad distribution and public education. We are optimistic that further exploration and stronger evidence will spark a new level of civic conversation about Prop 13 and property taxes, supported by local organizing and coalition building.